An analysis on the performance of the VICE ETF vs ESG Funds

Fund Performance:

Does Sinning Payoff?

Goal

To assess and predict the performance of ESG and sin stocks through regression modeling and statistical approaches

Results

By using data analysis and statistical approaches, I find evidence to suggest that ESG funds outperform (positive alpha). This outcome does not hold true for sin stocks.

By Jayden Reuben

Before I Start

Please click here if you’re only interested in the technical aspects of the analysis, such as data collection, processing, model-building, analysis, and robustness checks (redirects to my GitHub repository). The rest of this page is an article that simply discusses ESG vs sin stocks, the models, and my results.

This is intended to be a preliminary study, as I allude to later on in this article.

**Also note that from hereon in, this article is for informational purposes only. This is my own analysis on ESG- and sin-investing, and should not be taken as advice.

Introduction and Motivation

The shift toward social, environmental, and ethical responsibility intensifies as time advances. People are increasingly wary about their actions. They seek moral goodness. They want to be more socially responsible and green. This trend has spilled over into finance, where investors are not only concerned with risk and return, but also seek to do moral good by allocating their capital in a way that minimizes adverse impacts on the environment, promotes social responsibility, and ensures companies have sound corporate governance.

If you’re into reading or watching the news – particularly finance and business news – there’s no doubt you’ll often hear about ESG stocks/funds and socially-responsible investing (SRI). You’ll hear about avoiding sin stocks, and that you should remove them from your portfolio if you hold them. You’ll be persuaded to invest your capital into funds or ETFs that screen out “bad” stocks, such as tobacco, alcohol, weapons, gambling, etc.

This may be great for you if you’re conscious about “doing good” with your capital. However, this isn’t the focus of this article – nor is it the sole focus of most investors. Let’s go back to the risk and return aspect I brushed over just before. Is there a cost for screening out bad stocks (with respect to underperformance)? Does it pay to invest in ESG stocks? How do they perform relative to the market? Does it perhaps payoff to invest in sin stocks?

In this article, I attempt to answer these questions, to some extent. Although there aren’t many ETFs or funds dedicated to sin stocks, I’ve picked the VICE ETF as a proxy to represent sin stocks. I analyze the performance of the VICE ETF – which invests in sin stocks – and a couple of ESG-based ETFs.

Note that parts of this article will get quite stats- and finance theory-heavy. If you’re only interested in the results/discussion, scroll to the end.

Brief Literature Review

Literature on the performance of sin stocks and ESG funds is conflicting. Some provide evidence to suggest that sin stocks consistently outperform (Fabozzi, Ma, & Oliphant, 2008) while ESG firms and SRI funds underperform (Geczy, Stambaugh, & Levin, 2021), while others suggest the contrary. Blitz and Fabozzi (2017) suggest that sin stocks consistently outperform the market, but that this outperformance is statistically insignificant when controlling for profitability and investment (Fama & French Five-Factor Model).

I attempt to see whether I can expound on this literature. That is, to find out whether sin stocks outperform the market, and whether SRI and ESG-based ETFs underperform.

The Model

I assess fund performance using three models:

- Fama-French Three-Factor Model

- Fama-French Five-Factor Model

- Capital Asset Pricing Model (CAPM)

Three-Factor Model

The Three-Factor Model is a widely-used model to measure performance. It investigates the relationship between a specific asset’s excess returns (the VICE and ESG ETFs/Funds) and three factors:

- Market Risk Premium (MRP)

- The return on the market less the risk-free rate

- Value Premium (HML)

- Returns on value stocks less returns on growth stocks

- Size Premium (SMB)

- Returns on small cap companies less returns on large cap companies

HML is included because value stocks have a tendency to outperform growth stocks and the market. SMB is included because small-cap stocks tend to outperform large-cap stocks. Therefore, the addition of these two factors controls for these tendencies.

The Three-Factor model is specified as follows:

where:

is the excess return of the ETF/fund (

).

is the portfolio “alpha”

is the coefficient on each factor (sensitivity)

What we’re trying to establish here is whether the fund/ETF – such as the VICE or ESG-based (SRI) funds – outperform or underperform the market, given a set of factors (HML, SMB). This performance is captured by alpha (), and should be statistically insignificant if the model fully explains the ETF’s returns.

Five-Factor Model

The five-factor model was developed by Eugene Fama and and Kenneth French in 2015. While the three-factor model controlled for the value and small-cap premiums, this model controls for the following additional factors:

- Profitability factor (RMW)

- Returns on firms with robust profitability less returns of weak profitability firms (robust minus weak)

- Investment factor (CMA)

- Difference between firms that invest conservatively vs aggressively (conservative minus aggressive)

This is the model:

Using the same intuition as the three-factor model, we also control for the fact that firms with high investment in assets perform worse (than those that have lower investment), and for the fact that high profitability firms have a tendency to perform better (than low profitability firms).

Capital Asset Pricing Model

The CAPM is a much simpler alternative to the prior two models. It assesses performance based only on the market risk premium. As such, the CAPM model I use is as follows:

MRP, alpha (), and the other variables and coefficients in the CAPM retain the same meaning as those I’ve mentioned above.

Data

Fund and ETF Data

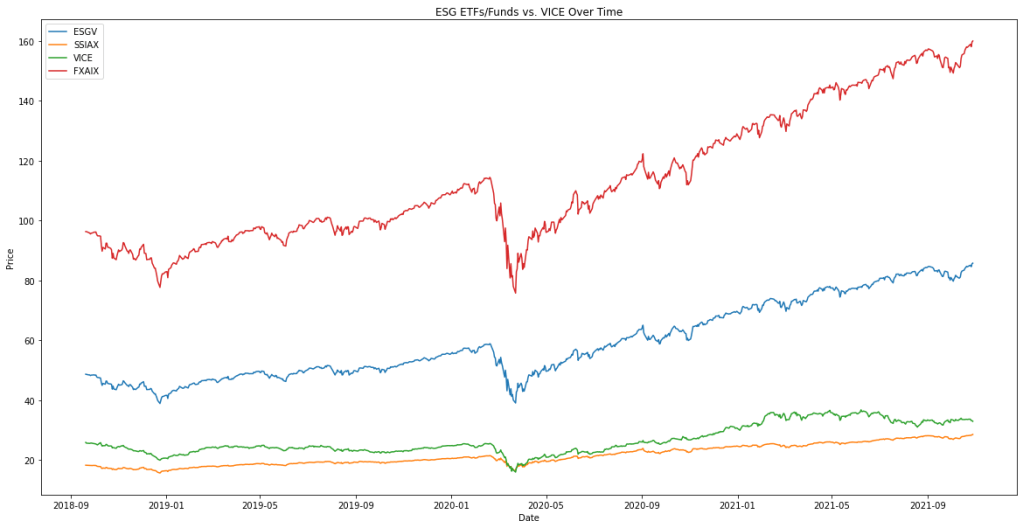

Daily close price data was collected from Yahoo Finance, using Yahoo Finance API via the yfinance library for Python.

Data on the following ETFs/funds are collected:

- AdvisorShares Vice ETF (VICE)

- Vanguard ESG U.S. Stock ETF (ESGV)

- 1919 Socially Responsive Balanced Fund (SSIAX)

- Fidelity 500 Index Fund (FXAIX)

The VICE is an ETF comprised only of sin stocks. The ESGV is an ESG-based ETF, while the SSIAX is an ESG fund. The FXAIX is a fund which seeks to mimic the S&P 500 index.

Factor Data

Given the funds I’ve included are all US-based (or at least mostly composed of US stocks), it makes sense to use US factor data. Kenneth French has a regularly-updated, extensive data library that contains data on factors based on US returns and interest rate data. I use French’s daily data in my analysis, which includes the previously-mentioned factors: MRP, HML, SMB, RMW, and CMA.

Time Period

The period I’ve included in this analysis is the three-year period between 1 November 2018 and 29 October 2021 (inclusive).

This is to capture recent activity – the medium-term rather than the long-term – and also due to the fact that the VICE ETF only started trading in December 2017. As such, the time period was specifically set to capture exactly three years.

Results

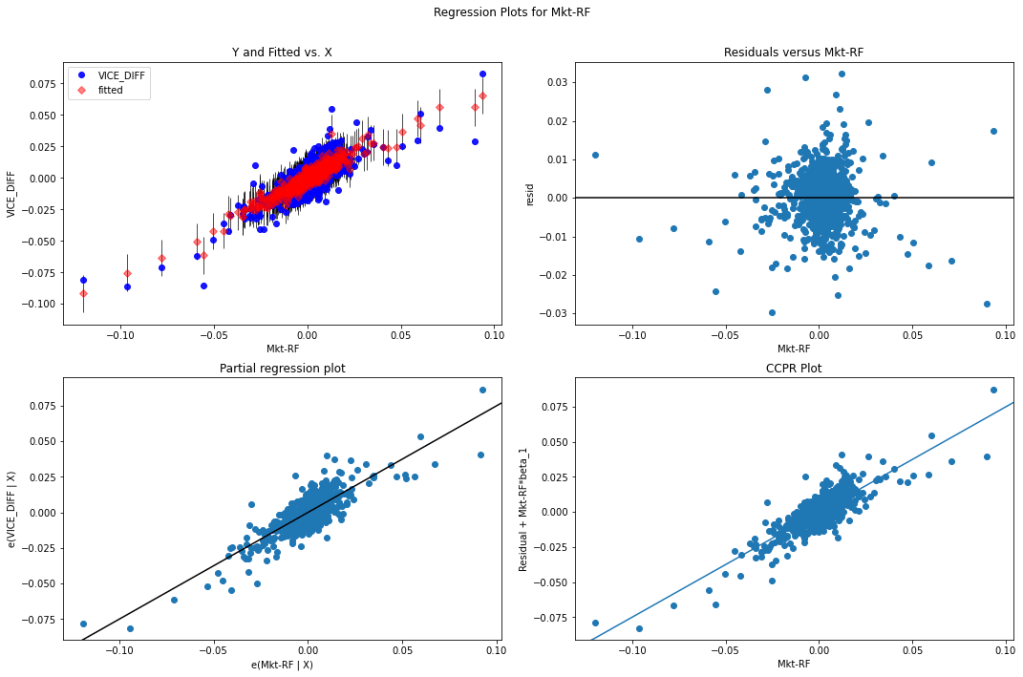

In this section, I’ll cover goodness of fit for the models and overall model significance. However, the main focus is on the alphas of the regression outputs, as the goal of this analysis was to assess performance. I do not report the full regression output in this article, but they can be found here (including comments on the significance of coefficients on factors).

Goodness of Fit & Overall Model

The VICE ETF has an adjusted value of 0.674 in the CAPM regression model.

increases when adding the additional factors under the Three- and Five-Factor models, to 0.740 and 0.749, respectively. The p-values for all three of the models are all virtually zero, thus meaning that the factors included in each regression reliably predict the excess return for VICE.

All other ETFs and funds have high adjusted values for each model, ranging from 0.96 – 0.99. This means that 96%-99% of the variance in the excess returns of each asset can be explained by the regressors in each model (e.g. MRP, HML, and SMB in the three-factor model). In addition, all of the model p-values (for the F-value) are effectively zero (meaning the factors reliably predict excess returns).

Alphas

My results show that under the CAPM, there is a positive alpha associated with the two ESG-based funds – SSIAX and ESGV, with both alphas being statistically significant at the 10% level (and SSIAX at the 5% level). Table 1 shows these alphas, along with the coefficients and respective p-values.

Table 1. CAPM Coefficients and Associated P-Values

| VICE | ESGV | SSIAX | FXAIX | |

|---|---|---|---|---|

| Alpha | -0.00023 (0.444) | 8e-05 (0.08) | 0.00013 (0.042) | -1e-05 (0.898) |

| MRP | 0.7925 (0.0) | 0.98305 (0.0) | 0.6432 (0.0) | 0.98211 (0.0) |

Interestingly, my results also show that VICE does not outperform the market (p=0.444). The FXAIX also, unsurprisingly, does not outperform the market, which is to be expected given that it is supposed to mirror the S&P 500.

When I control for value and size premiums as part of the Three-Factor Model (HML & SMB), the ESGV ETF loses its statistical significance (p=0.12), but the alpha for the SSIAX Fund remains significant at the 10% level (Table 2).

Table 2. Three-Factor Coefficients and Associated P-Values

| VICE | ESGV | SSIAX | FXAIX | |

|---|---|---|---|---|

| Alpha | -0.00019 (0.46673) | 6e-05 (0.12394) | 0.0001 (0.05453) | 1e-05 (0.8575) |

| MRP | 0.74323 (0.0) | 0.99117 (0.0) | 0.65836 (0.0) | 0.99127 (0.0) |

| SMB | 0.46434 (0.0) | -0.0365 (0.0) | -0.05895 (0.0) | -0.14094 (0.0) |

| HML | -0.03883 (0.12606) | -0.0343 (0.0) | -0.07343 (0.0) | 0.06279 (0.0) |

When profitability (RMW) and investment (CMA) factors are included, as part of the Five-Factor Model, the alpha for SSIAX remains significant at the 10% level (p=0.07), and all other alphas remain indistinguishable from zero (Table 3).

Table 3. Five-Factor Model Coefficients and Associated P-Values

| VICE | ESGV | SSIAX | FXAIX | |

|---|---|---|---|---|

| Alpha | -0.00013 (0.6102) | 5e-05 (0.18596) | 9e-05 (0.07314) | -1e-05 (0.62153) |

| MRP | 0.75433 (0.0) | 0.98748 (0.0) | 0.652 (0.0) | 0.99371 (0.0) |

| SMB | 0.38689 (0.0) | -0.02295 (0.00011) | -0.04662 (0.0) | -0.1181 (0.0) |

| HML | 0.02196 (0.50957) | -0.04059 (0.0) | -0.07165 (0.0) | 0.03063 (0.0) |

| RMW | -0.30803 (0.0) | 0.05792 (0.0) | 0.05972 (0.0) | 0.07752 (0.0) |

| CMA | 0.11991 (0.10563) | -0.04449 (9e-05) | -0.0812 (0.0) | 0.04185 (0.0) |

Limitations, Robustness, and Other Considerations

There are some inherent assumptions within these models that cause limitations. Specifically, these models (as specified) are inflexible to additional variables – such as additional risk factors (e.g. momentum). Additionally, I’ve assumed that these models are correctly specified and that there is no heteroscedasticity. I’ve done so based on the widespread acceptance and usage of these models.

Serial Correlation

The Durbin-Watson (DW) statistic for each of the regressions ranged between 1.9 and 2.4, which was within an acceptable range (1.5-2.5). However, with these DW statistics differing from 2 – very mild autocorrelation does exist based on these tests (in both directions). This output can be viewed here.

Functional Misspecification

Further to my previous comment on model specification, a limitation is that I did not test for functional misspecification. There is a possibility that nonlinearities exist within these models. Including higher-order fitted terms (of the response variables) in each regression would be an appropriate step to test for misspecification (i.e. Ramsey’s RESET).

Heteroscedasticity

Another limitation is that I’ve accepted homoscedasticity within the model. This is where the error variance is assumed constant. However, as is often the case with financial data, conditional heteroscedasticity could be present, thus impacting the standard errors of the parameters. Once testing for misspecification, it would also be beneficial to run a Breusch Pagan test for heteroscedasticity, and correct for it by either using heteroscedasticity-robust standard errors, transformation, or weighted least squares.

Proxies

Another implication of these tests is that I’ve used the VICE ETF as a proxy for sin stocks, and the SSIAX Fund and ESGV ETF as proxies for SRI. In a future analysis (which I may include here), I intend on screening for stocks within specific industries (sin stocks) and including them in this study, while including more ESG ETFs/funds.

Another implication with using funds and ETFs as proxies, in the context of this model, is that there is an idiosyncratic risk component with respect to how the fund/ETF is managed. Thus, handpicking sin stocks by industry and picking a well-diversified, passive ETF/fund would circumvent this problem.

Time Period

Based on the availability of data (with the ETFs and funds included), the only full years available for analysis were 2018-2021.

The past couple of years have been a wild ride with the emergence and persistence of COVID-19, so it would be remiss of me not to mention this as a limitation, as there could be other confounding factors that should be accounted for. The observed time period within this analysis could be extended out, with time dummies included to control for COVID/non-COVID years, and other financial crises (if the study included those years).

Discussion & Conclusion

Earlier in this article, I discussed the varying literature on the performance of sin stocks and ESG/SRI ETFs/funds. However, I mentioned literature that suggests ESG funds underperform and sin stocks outperform.

My results section above shows that the VICE ETF (as a proxy for sin stocks) does not outperform the market in any of the models assessed.

Moreover, both ESG-based funds have significant alphas at the 10% significance level under the CAPM. However, the significance for ESGV’s alpha disappears once controlling for size and value, which persists when adding additional factors (CMA and RMW).

So, let’s address the big question: Does sinning payoff?

Well, no, based on my results – which are consistent with the framework of each respective model. Sinning does not appear to payoff. However, there is some evidence to suggest that ESG-investing may payoff – but further investigation would be needed here, as discussed in the prior section with respect to robustness and proxies/asset-selection.

However, if you don’t believe that the CAPM nor the Five/Three-Factor models adequately explain performance, I would take the results from my preliminary study/analysis with a grain of salt. As I’ve mentioned in the prior section, I intend on taking a different approach with respect to sin stock and ESG selection in a future, more comprehensive study – that is, going beyond using ETFs/funds, and simulating portfolios of sin and ESG stocks (selecting these by industry and ESG criteria). I also intend on controlling for periods of uncertainty (i.e. COVID-19) and implementing enhanced robustness tests in a future analysis.

Helping you achieve analytics-driven success.

Locations

Auckland, New Zealand

Worldwide (Remote)

Contact

jayden@jaydenreuben.tech

+64 9 889 8031