GARCH Volatility Modeling

Click here to see my GARCH volatility model (GitHub).

Goal

To train a model to predict the volatility of stocks in the next 7 days.

Results

I find that the GARCH(1,1) model is appropriate for predicting the volatility of the selected fund. Using this model, I predict the 7-day, daily volatilities of an ESG fund.

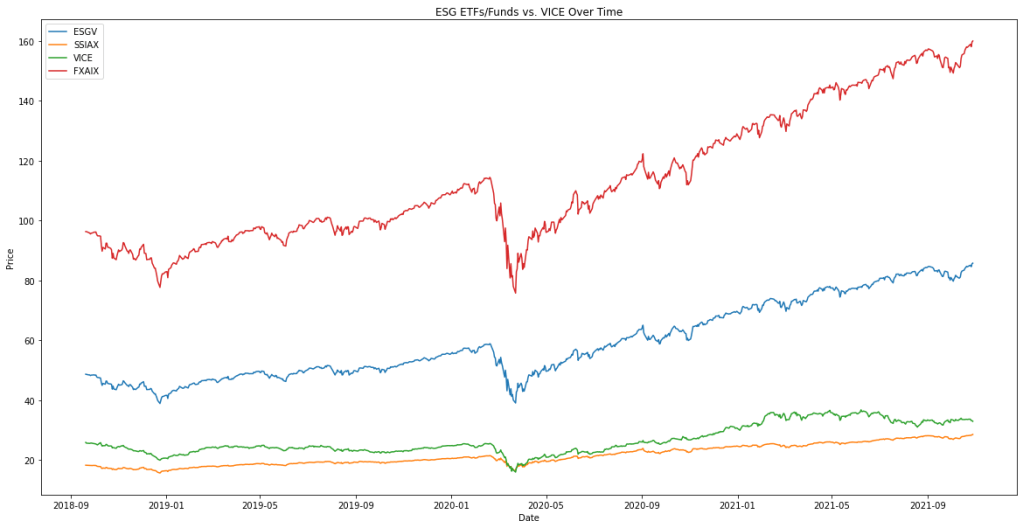

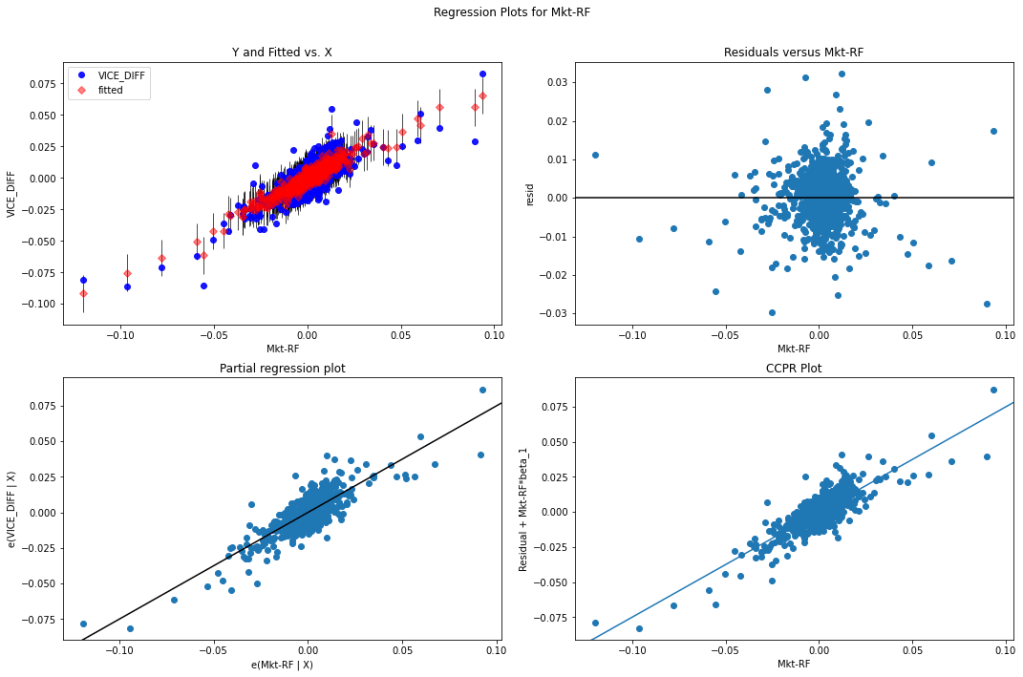

Project: Does Sinning Payoff?

An analysis on the performance of the VICE ETF vs ESG Funds

This project dives into the performance of sin stocks and ESG funds/ETFs. I employ CAPM and two very popular multifactor models to test whether these funds outperform the market.

Click here to view this project.

Helping you achieve analytics-driven success.

Locations

Auckland, New Zealand

Worldwide (Remote)

Contact

jayden@jaydenreuben.tech

+64 9 889 8031